In order to stay ahead of the others, ones must be alert and sensitive towards the changes in the market. Just like mobile phone, it is gradually replacing the ways we used to have last time. Do you actually notice that?

A recent report has revealed that the majority of premium brands are failing to keep up-to-date with the opportunities presented by mobile marketing.

The latest L2 Prestige Mobile IQ report suggests that use of effective mobile marketing practices is currently surprisingly low amongst top brands.

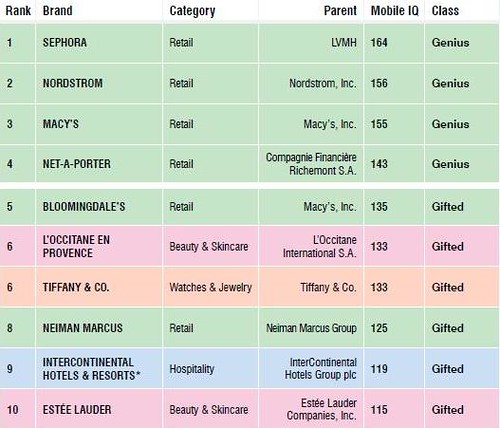

The report looked at mobile applications, mobile sites, mobile marketing (including SMS) and overall innovation and integration, ranking brands included in the study on their Mobile IQ score.

L2 argues that over the next few years, the businesses which will thrive are those willing to engage with mobile marketing techniques. Brands need to develop and optimize powerful mobile commerce sites which are accessible from a range of devices.

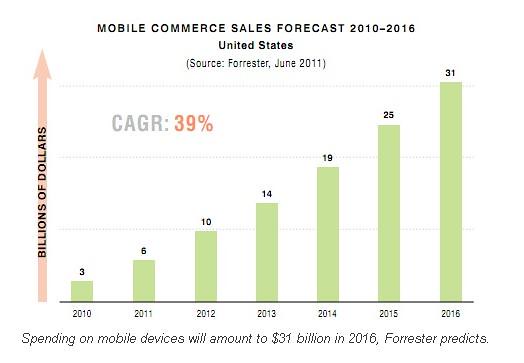

According to Forrester’s report in 2011, m-commerce sales are set to quintuple over the next five years, resulting in $31 billion worth of sales by 2016.

However, despite this forecast, a shocking 16% of the brands in the L2 report are yet to produce any kind of mobile app or website. In fact, almost half of the brands studied were ranked as ‘feeble’, meaning that their investment in mobile to date is little if any.

The brands at the top are offering engaging mobile apps, fully optimized m-commerce sites and flashes of creative genius.

These brands have managed to create some really effective mobile offerings which are often fully integrated into their rest of their offline marketing campaigns.

And those languishing at the bottom:

How are these brands letting themselves down with mobile?

The main reason these brands appear to be lagging behind is because they fail to utilise the unique platforms that m-commerce, iPhone and iPad apps offer.

1. Failures in M-commerce

Those languishing at the bottom of the list are there because they don’t capture the quality of their websites in their mobile experience. Generally, across every category measured, mobile sites consistently failed to replicate the features found on their main sites such as video and product search. Another significant issue they face is that they are directly hindering m-commerce by hosting websites in Adobe flash – which iOS does not support.

2. User experience problems on the iPhone

As the report suggests, the majority of the 70% of brands which have iPhone apps appear to consistently fail to make sure that the user experience is really excellent. Less than a third of these apps use the iPhone’s GPS software, 17% of apps utilise the notification system and even fewer use the phone’s camera and gyroscope capabilities.

L2 quotes ABI Research which reports that the iTunes Store ranking algorithm will begin taking into account qualitative information such as user reviews and frequency of usage. As such, there is little point having a promotional app with little functionality in order to simply maintain appearances. Brands need to invest in mobile apps which are valuable to the consumer and which garner great customer feedback.

What’s next?

- Brands need to invest in m-commerce now to take advantage of the increase in mobile usage.

- They need to create a seamless customer experience across a number of devices.

- Mobile apps need to provide real value and utilise the unique functionality of mobile devices.

By 2015, it is predicted that more users will access the Internet wirelessly via a mobile device than from a wired Ethernet connection. As consumers move their purchasing power from computer to mobile, brands cannot afford to be prudish about innovation in mobile marketing.ovation in mobile marketing.

Source: By Katie Glass on 19th January 2012.

Web SMS, 1-way Messaging, 2-way Messaging, SIM Hosting, Email-to-SMS, Developer (HTTP API & SMPP), White Label Reseller Program, HRL Lookup, Long Code Service, Non-premium Short Code, Industry Based Solutions etc. To know more about our products & services, visit our official websites: www.moceansms.com | www.bulksms.com.my | www.mocean.com.my

Category

- Africa (5)

- América Latína (4)

- Argentina (3)

- Asia Pacific (12)

- Australia (6)

- Azerbaijan (1)

- Bolivia (1)

- Brazil (1)

- Canada (1)

- Chile (4)

- China (6)

- Colombia (1)

- Ecuador (1)

- Europe (4)

- General (111)

- Ghana (1)

- Hong Kong (1)

- India (1)

- Indonesia (16)

- Ireland (1)

- Israel (1)

- Kenya (1)

- Malaysia (1)

- México (2)

- Middle East (1)

- Nepal (1)

- New Zealand (1)

- Nigeria (4)

- Pakistan (7)

- Paraguay (1)

- Perú (2)

- Philippines (4)

- Singapore (3)

- Slovakia (1)

- South Africa (3)

- Tanzania (3)

- Thailand (1)

- UAE (1)

- UK (8)

- Ukraine (1)

- Uruguay (1)

- US (6)

- Venezuela (1)

- Zimbabwe (1)

Friday, 20 January 2012

Mobile Commerce: How Brands are Falling Behind

Wednesday, 18 January 2012

Australia - Mobile Payments Could Replace Cash By 2016

Are you running on the same pace as "c-h-a-n-g-e"? No? Trying to catch up? Yes but barely can breathe? =) Anyway, as the title suggests, you and I may tend to pay without taking cash from physical wallets. Instead, we will be using our electronic devices to make payments. So, are you ready to move forward with us?

Paying for everyday items with your mobile phone will be commonplace within a couple of years.

It's no secret that mobile payments are growing by leaps and bounds. It's not hyperbole to say that mobile payments are the future of financial transactions, especially in the consumer-to-business marketplace. Is that future happening sooner than you might think? It looks that way - if a new report from Forrester Research and PayPal has it nailed.

Change is Coming Sooner Than You Think

First, know that mobile payments are already widely viewed as being "mainstream." A July 2011 study from KPMG notes that 72% of business executives say that such payments, on a large scale, are inevitable. Another 58% say that their companies already have a mobile payment system in place.

"We believe that exploding smartphone growth and a myriad of opportunities will grow mobile payments at a much faster rate than our respondents anticipate," said Gary Matuszak, KPMG global chair of the Technology, Communication and Entertainment practice, in a statement. "A wide variety of payments is ready for adoption, as several key players already provide or are rolling out mobile payments, and interest among consumers in utilising mobile payments is growing, in line with the industry's readiness to deploy them."

That could be happening faster than even the most optimistic mobile payment advocate could have hoped. Recent data from the U.K. arm of Forrester Research, in partnership with PayPal, estimates that mobile payments will replace other forms of payment by 2016.

No Wallet? Use Your Smartphone Instead!

A PayPal article, entitled No Wallet Required, examined the British mobile payment marketplace and concluded that "digital money" will become the go-to payment method within the next four years.

"We'll see a huge change over the next few years in the way we shop and pay for things," says Carl Scheible, Managing Director of PayPal U.K. "By 2016, you'll be able to leave your wallet at home and use your mobile as the 21st century digital wallet. Our vision of money is to enable you to pay for something from wherever you are, whatever device you're on – a PC, mobile phone, tablet, games console [sic] and a whole lot more."

Scheible adds that paper currency won't go away entirely, but will face a diminishing demand. "The lines between the online world and high street will soon disappear altogether," he says. "Children born today will become the first 'cashless generation.' It will be completely natural for them to pay by mobile."

PayPal should know. It already processed about A$3.6 billion in mobile payments in the U.K. in 2011 alone – that's five times the amount that the online payment giant saw in 2010.

Australians Love Their Smartphones

Australia has the second highest rate of smartphone penetration in the world, only Singaporeans use the device more than us. A staggering 28 per cent of visits to banking sites in this country are now made through a mobile device reports The Australian Financial Review. This is up from just 2 per cent in 2009.

Locally, mobile has rapidly become the most important battleground for retail and banking institutions as they look to defend their payment turf from a host of emerging competitors, including technology and social start ups.

The Bottom Line

The British report concludes that the trend to mobile payments is only growing stronger with each passing year. About 50% of all mobile or smartphone device users bought something via mobile payments in the three months leading up to the publishing date of the study.

That number will grow, the data shows, and will cement mobile payments as the payment of choice for consumers not just in the U.K. but also here in Australia.

Paying for everyday items with your mobile phone will be commonplace within a couple of years.

It's no secret that mobile payments are growing by leaps and bounds. It's not hyperbole to say that mobile payments are the future of financial transactions, especially in the consumer-to-business marketplace. Is that future happening sooner than you might think? It looks that way - if a new report from Forrester Research and PayPal has it nailed.

Change is Coming Sooner Than You Think

First, know that mobile payments are already widely viewed as being "mainstream." A July 2011 study from KPMG notes that 72% of business executives say that such payments, on a large scale, are inevitable. Another 58% say that their companies already have a mobile payment system in place.

"We believe that exploding smartphone growth and a myriad of opportunities will grow mobile payments at a much faster rate than our respondents anticipate," said Gary Matuszak, KPMG global chair of the Technology, Communication and Entertainment practice, in a statement. "A wide variety of payments is ready for adoption, as several key players already provide or are rolling out mobile payments, and interest among consumers in utilising mobile payments is growing, in line with the industry's readiness to deploy them."

That could be happening faster than even the most optimistic mobile payment advocate could have hoped. Recent data from the U.K. arm of Forrester Research, in partnership with PayPal, estimates that mobile payments will replace other forms of payment by 2016.

No Wallet? Use Your Smartphone Instead!

A PayPal article, entitled No Wallet Required, examined the British mobile payment marketplace and concluded that "digital money" will become the go-to payment method within the next four years.

"We'll see a huge change over the next few years in the way we shop and pay for things," says Carl Scheible, Managing Director of PayPal U.K. "By 2016, you'll be able to leave your wallet at home and use your mobile as the 21st century digital wallet. Our vision of money is to enable you to pay for something from wherever you are, whatever device you're on – a PC, mobile phone, tablet, games console [sic] and a whole lot more."

Scheible adds that paper currency won't go away entirely, but will face a diminishing demand. "The lines between the online world and high street will soon disappear altogether," he says. "Children born today will become the first 'cashless generation.' It will be completely natural for them to pay by mobile."

PayPal should know. It already processed about A$3.6 billion in mobile payments in the U.K. in 2011 alone – that's five times the amount that the online payment giant saw in 2010.

Australians Love Their Smartphones

Australia has the second highest rate of smartphone penetration in the world, only Singaporeans use the device more than us. A staggering 28 per cent of visits to banking sites in this country are now made through a mobile device reports The Australian Financial Review. This is up from just 2 per cent in 2009.

Locally, mobile has rapidly become the most important battleground for retail and banking institutions as they look to defend their payment turf from a host of emerging competitors, including technology and social start ups.

The Bottom Line

The British report concludes that the trend to mobile payments is only growing stronger with each passing year. About 50% of all mobile or smartphone device users bought something via mobile payments in the three months leading up to the publishing date of the study.

That number will grow, the data shows, and will cement mobile payments as the payment of choice for consumers not just in the U.K. but also here in Australia.

Monday, 16 January 2012

Indonesia - Mobile Penetration at 147% by 2016

Mobile penetration in Indonesia is growing continuously and is expected to reach 147% by 2016. Wow, it means mobile penetration rate > total population in Indonesia! Amazing~ It's indeed a lucrative market to tap into as people are holding at least one mobile phone is their hands.

JAKARTA (IFT) – Mobile telecommunications in Indonesia is estimated to reach 147 percent in 2016, higher than this year’s 119 percent estimate. The growth reflects the ongoing saturation in the mobile phone industry and the growth of the operator business, according to the Indonesian Mobile Telecommunications Association (Asosiasi Telekomunikasi Seluler Indonesia/ATSI).

Sarwoto Atmosutarno, Chairman of ATSI, said that the mobile phone industry has entered the saturation phase with mobile telecommunications penetration at around 110 percent. This caused the tight competition between operators, which in turn, caused lower voice and SMS tariffs.

"Due to the competition, the average revenue per user (ARPU) is estimated to reach only Rp 20,000 per month this year,” Sarwoto said.

The low ARPU resulted to the industry's estimated growth of around seven to nine percent. It will be mainly boosted by the largest mobile phone operators, PT Telekomunikasi Selular (Telkomsel), PT Indosat Tbk (ISAT) and PT XL Axiata Tbk (EXCL). The companies' revenues reached Rp 60 trillion (US$ 6.6 billion) in the third quarter of 2011.

Sarwoto explained that the crowded market will move towards mobile broadband services. This means that the data services market will continue to be large, since new users only reached around 70 million last year.

This year, the association projects that the business growth of mobile broadband will reach 100 percent, since the market potential for operators is high. It will also grow significantly if it is supported by related ecosystems such as affordable smart phones, application and content.

"The application or content business will contribute more than 20 percent in the next five years. The association will continue to boost the partnership with provider content,” Sarwoto said.

The association notes that operators are continuing to increase base transceiver station (BTS) units with 3G technology to develop data services. At the end of 2011, there were 22 thousand 3G BTS units of a total of 97 thousand. Last year, three large operators allocated around Rp 30 trillion to develop infrastructure that support data services.

PT Ericsson Indonesia, telecommunications infrastructure provider, estimates that mobile broadband users in Indonesia will reach 150 million by year-end. This is a 150 percent increase from 60 million users last year. Meanwhile, circulated subscriber identity module (SIM) cards are estimated to grow to around 300 million.

Hardyana Syintawati, Vice President of Marketing & Communications of PT Ericsson Indonesia, said that the growth is mainly boosted by the high use of devices that can access wireless internet, such as smart phones, tablet computers, modem dongles and wireless fidelity (WiFi). With the more affordable prices of the devices, use has intensified.

Operator Competition

Fitch Ratings estimates that five telecommunications operators in Indonesia will see significant growths this year despite the tough competition. However, with revenues from voice and SMS services continuing to decline, their growth will be in the low single digit.

The operators are PT Telekomunikasi Indonesia Tbk (TLKM), PT Telkomsel, PT Indosat, PT XL Axiata and PT Bakrie Telecom Tbk (BTEL). There are 10 telecommunications operators in Indonesia as of 2011.

Any Sirapurna, Associate Director of Fitch Ratings, said that the five telecommunications operators control up to 90 percent of the telecommunications market in Indonesia. They are estimated to reach profit before interest rate, taxes, depreciation and amortization exceeding 50 percent. This is due to customer growth and higher revenues from network leasing. (*)

Source: By MUHAMMAD IQBAL on 16th January 2012

JAKARTA (IFT) – Mobile telecommunications in Indonesia is estimated to reach 147 percent in 2016, higher than this year’s 119 percent estimate. The growth reflects the ongoing saturation in the mobile phone industry and the growth of the operator business, according to the Indonesian Mobile Telecommunications Association (Asosiasi Telekomunikasi Seluler Indonesia/ATSI).

Sarwoto Atmosutarno, Chairman of ATSI, said that the mobile phone industry has entered the saturation phase with mobile telecommunications penetration at around 110 percent. This caused the tight competition between operators, which in turn, caused lower voice and SMS tariffs.

"Due to the competition, the average revenue per user (ARPU) is estimated to reach only Rp 20,000 per month this year,” Sarwoto said.

The low ARPU resulted to the industry's estimated growth of around seven to nine percent. It will be mainly boosted by the largest mobile phone operators, PT Telekomunikasi Selular (Telkomsel), PT Indosat Tbk (ISAT) and PT XL Axiata Tbk (EXCL). The companies' revenues reached Rp 60 trillion (US$ 6.6 billion) in the third quarter of 2011.

Sarwoto explained that the crowded market will move towards mobile broadband services. This means that the data services market will continue to be large, since new users only reached around 70 million last year.

This year, the association projects that the business growth of mobile broadband will reach 100 percent, since the market potential for operators is high. It will also grow significantly if it is supported by related ecosystems such as affordable smart phones, application and content.

"The application or content business will contribute more than 20 percent in the next five years. The association will continue to boost the partnership with provider content,” Sarwoto said.

The association notes that operators are continuing to increase base transceiver station (BTS) units with 3G technology to develop data services. At the end of 2011, there were 22 thousand 3G BTS units of a total of 97 thousand. Last year, three large operators allocated around Rp 30 trillion to develop infrastructure that support data services.

PT Ericsson Indonesia, telecommunications infrastructure provider, estimates that mobile broadband users in Indonesia will reach 150 million by year-end. This is a 150 percent increase from 60 million users last year. Meanwhile, circulated subscriber identity module (SIM) cards are estimated to grow to around 300 million.

Hardyana Syintawati, Vice President of Marketing & Communications of PT Ericsson Indonesia, said that the growth is mainly boosted by the high use of devices that can access wireless internet, such as smart phones, tablet computers, modem dongles and wireless fidelity (WiFi). With the more affordable prices of the devices, use has intensified.

Operator Competition

Fitch Ratings estimates that five telecommunications operators in Indonesia will see significant growths this year despite the tough competition. However, with revenues from voice and SMS services continuing to decline, their growth will be in the low single digit.

The operators are PT Telekomunikasi Indonesia Tbk (TLKM), PT Telkomsel, PT Indosat, PT XL Axiata and PT Bakrie Telecom Tbk (BTEL). There are 10 telecommunications operators in Indonesia as of 2011.

Any Sirapurna, Associate Director of Fitch Ratings, said that the five telecommunications operators control up to 90 percent of the telecommunications market in Indonesia. They are estimated to reach profit before interest rate, taxes, depreciation and amortization exceeding 50 percent. This is due to customer growth and higher revenues from network leasing. (*)

Source: By MUHAMMAD IQBAL on 16th January 2012

Subscribe to:

Posts (Atom)